China LED lights Chip Gross Production Increases

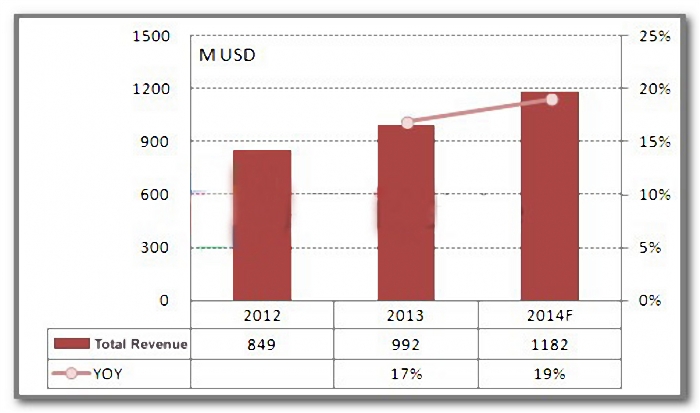

11-01-2014Gross production of LED lights chips by domestic Chinese companies (listed companies with mainly Chinese investment backgrounds) was US $8.49 million (NT $255 million), a year over year increase of 17%. Rapid increase of penetration rate for LED commercial lighting and vehicular lighting has also pushed up LED lights chip production utilization rates in 2013. However, due to continued drop in LED lights chip prices, the extent of increase for gross production has been less than production volume. It is estimated that both will have equal growth in 2014, increasing gross production to US $9.92 million.

Chart 1: Gross production of Chinese domestic manufacturers and predictions

Domestic chip production reaches 80 percent drived by strong lighting chip demands

The LED commercial and vehicular lighting market had strong demands in the first half of 2013. Increased transformation by conventional lighting and midstream package manufacturers integrated with downstream lighting one after another, lead to mid-power lighting chip shortages during the first half of last year.

LED lights chip manufacturers’ utilization rates rapidly increased. Electech LED chip revenue in 2012 reached US$ 35.5 million, and grew more than 50 percent in 2013 to an estimated US$ 56.5 million. Epitop revenue growth doubled in in 2013. Utilization rates for San’an Opto, Tongfang, and Haulei Optoelectronics all maintained high levels.

Display chip manufacturers have been expanding lighting chip business one by one. HC SemiTek revenue share for LED lights chips is gradually increasing and is estimated to reach 50 percent by the end of 2013. Silan Azure Co. newly added machines will mainly be used for production of chips for more LED lights applications.

With domestic Chinese chip manufacturers taking off, Taiwanese and international manufactures presence in China is slowly declining. Information shows that domestic production rates for Chinese LED lights chips have already reached 80 percent in 2013.

The trend in chips rapid price drops used in displays continued in 2013. Company profits did not increase with rising revenues, but dropped drastically due to price declines. This is one of the reasons companies have expanded chip manufacturing businesses for lighting.

Market concentration increases and industry integration flourishes

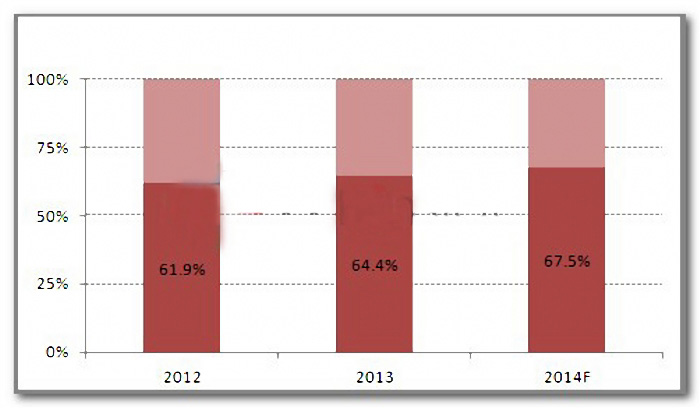

Concentration within the Chinese LED lights chip industry increased in 2013. Market revenue share for the top five manufactures increased from 61.9 percent in 2012 to 64.4 percent. The continued development of the industry and increasing concentration rate makes industry reorganization and integration hard to avoid. Although, currently speeds of price drops have eased, it is still hard to increase company profitability. Mid to small sized chip manufacturers who lack funds and technology either go out of business or become potential companies for M&A.

Chart 2: Top 5 chip manufacturers gross production proportion and predictions

LED lights market to still grow in 2014, manufacturers gradually enter 4 inch epitaxial technology

Decelerated growth of backlight and display panels has caused chip manufacturers to turn their focus towards LED lights in 2014. It is estimated that global LED lighting gross market value in 2014 will reach US $17.8 billion with shipment volume of 1.32 billion pcs, a year over year growth of 68 percent compared with 2013.

As for technology, the proportion of Chinese manufacturers entering into 4 inch epitaxial growth technology has increased. Aside from Electech, who has adopted the technology 100 percent, it is estimated that San’an Opto, HC SemiTek, and NationStar applications will reach 30 percent and up. Flip chip is also a technology manufacturers are paying attention to, due to advantages in high powered lighting and widely adoption in flash applications.