Epistar and FOREPI Merger to Bring New Golden Era to Taiwan LED Industry

05-07-2014

The merger between LED chip manufacturer Epistar and FOREPI has caused much discussion in the industry. Professionals have different views on the trend of large LED upstream manufacturers dominating the market. While foreign investment firms are optimistic the merger will create a win-win situation for Epistar and FOREPI, other Chinese companies worry it will have a negative impact on downstream manufacturers.

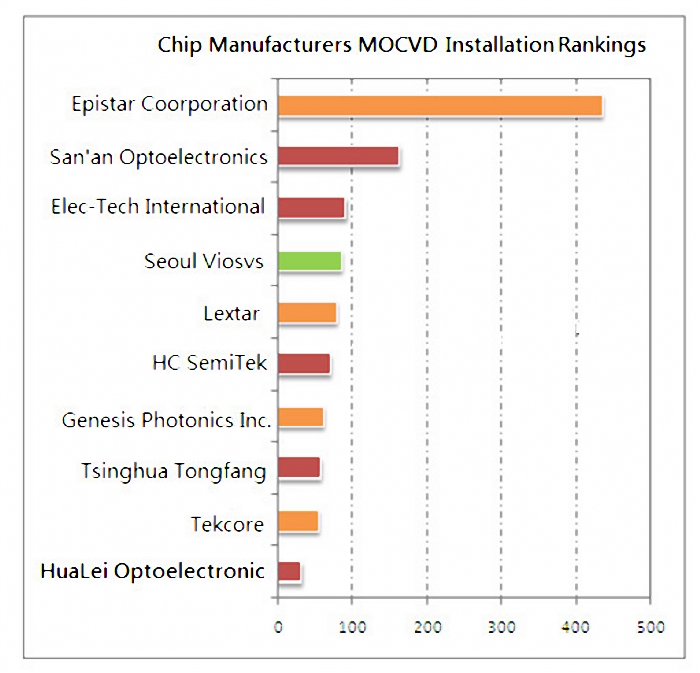

At a recent stockholder meeting, Epistar Chairman B.J. Lee said the LED industry should see the most of the coming golden three years. Epistar estimated the LED lights market sector will enter an explosive growth phase in the next two to three years, and the LED lights penetration rates will reach 60 percent to 70 percent by 2017.Intensive market competition and large international market demands have set in motion restructuring and alliance forming trends. Epistars acquisition of FOREPI will integrate resources, expand production capacity, and assist the company in securing its market position. The industry is focused on whether the merger will allow Epistar to defeat major opponent San’an Optoelectronics (Sanan Opto), and form an alliance with second largest rival FOREPI.

In other view, the outcome of the merger between the two major Taiwanese LED chip manufacturers is helpful for the countrys LED industry development. The merger provides an opportunity for Taiwans upstream LED industry to enter a leading position in terms of production capacity and technology. Moreover, the acquisition is creating new division of work, cooperation circumstances and concepts between LED manufacturers in Taiwan and mainland China.

Japanese investor from Mitsui Co. urged Epistars absorption of FOREPI to bridge production capacity gap

Epistar has reached full production capacity fastest among Taiwanese LED manufacturers, said Epistar Spokesperson Rider Chang. The company has already manufactured 0.95 million LED chips in first half of 2014, but still faces supply shortage of 0.30 million. The lasting production capacity shortage is expected to expand in second half of 2014. Enlarging the companys production capacity will be too slow to solve the production shortage.

Moreover, with rising LED market growth, choosing FOREPI as a partner is the best choice for Epistar. FOREPI is the second largest LED chip manufacturer in terms of production capacity, and also ranks second in LED technology. Furthermore, FOREPIs 400 staff R&D team can strengthen Epistar’s R&D. FOREPIs second largest stockholder and Chairman Suzuki Jiro, who is also the Manager of LED Business Office in Electronic Industry Business Unit of Main Information Industry Unit in Mitsui Co., was the key person behind the recent merge, said FOREPI Chairman Fen-ren Chien. The integration of the two largest LED chip manufacturers is a right decision for Taiwanese industry development.

For instance, after Epistar acquired Huga Optotech in 2009, the two companies were able to raise technology standards and product quality to similar levels within six to 12 months, and even integrate corporate cultures, said Chang. Epistar and FOREPIs readjustment period to minimize differences will also be targeting six to 12 months and maybe even shorter. Based on FOREPIs current production capacity plans of reaching 0.3 million LED chips, the companys consolidated revenue is estimated to reach NT $7.5 billion (US $251 million) after the merge. The company is expected to lower operating ratio to below six percent, and if gross margin reaches 10 percent the company will be raking in NT $300 million net profit. FOREPIs Earning Per Share (EPS) will surpass NT $2 if the companys gross margin reaches a similar standard to Epistars 12 percent to 15 percent.

FOREPI to reduce losses after balancing supply and demand

Supply and demand conditions often affect gross margin performances, gross margins can be improved by balancing supply and demand, said Epistar General Manager Chou Ming-chun. Although, lowered manufacturing costs has become the main factor behind the LED lighting industrys rapid growth, it has also become a source of stress for manufacturers. Instead of bargaining over prices when working with clients, it would be better to provide clients different value products to maintain Average Selling Price (ASP), explained Chou. Another solution is to offer higher priced products, for example developing co-activation services with clients to improve product features, or develop specially designed HV LED and flip chip products.

FOREPI can definitely reduce long term losses after merging with Epistar. The main reason behind the losses included FOREPI’s higher manufacturing costs than Epistar and lower ASP, said Chien. FOREPI can lower manufacturing costs after integrating production capacity with Epistar. At first, the two companies will cooperate under an OEM model. Epistar will be outsourcing 35 percent LED chip OEM orders to FOREPI at a rate higher than the laters ASP, said Chien. FOREPIs production capacity target is set at 0.4 million pcs. Moreover, due to significantly lowered equipment depreciated costs in 3th quarterh in 2014 and increased ASP, the company has a chance to becoming profitable.

Sanan Opto will not be able to have a seat on Epistars board

FOREPIs largest shareholder Sanan Opto, who has a 19.77 percent stake in the company did not recommend any board member candidates during FOREPIs board election in June 2014. The companys actions caused a lot of market speculations. Now that FOREPI sudden agreement to swap all stocks and become a wholly owned subsidy of Epistar. The merger between the top two Taiwanese LED chip manufacturers and Sanan Optos future actions are all under attention of the LED industry . Both Epistar and FOREPI have declined to comment about competitor Sanan Optos future strategy.

Epistar has prepared all necessary measures to protect Sanan Optos rights, said Chang. Sanan Opto can choose whether it wants to keep the 120 million stocks in FOREPI, or convert them for Epistar shares. If the Chinese LED chip manufacturer decides to swap shares, it will have a 3.1 percent stake in Epistar, but the investment will still need to acquire approval from Taiwans Investment Commission and related government agencies. Even with a 3.1 percent stake in Epistar, it will still be difficult for Sanan Opto to win a seat on the Taiwanese companys nine member board committee, said out Chang. It will depend on the companys shareholder reelection meeting in the next two years to judge whether the mainland rival will become a board member.

Epistars patent advantages establish trend of large upstream LED manufacturers dominating the market

In addition, Epistar is the first Taiwanese manufacturer to have signed patent license agreements with top international LED manufacturers including Toyoda Gosei and Philips. The agreements approves interchange and usage of the two companies LED patents, making Epistar the first Taiwanese company to break through the international LED chip patent barrier. Epistar has fully displayed its patent technology and market position through patent license agreements with international manufacturers. The company has also improved ininternational competitiveness, and will have a total of 3,000 patents after absorbing FOREPI. Epistar will have more leadership in the industry with its extended patent collection.

Epistar and FOREPIs merger is just the first start, and there is still a very long way to go, said Chou. The companies will cooperate more closely from now on, and hopefully the partnership will help Taiwans LED industry performance in the global market.