NEWS

NEWS

Chinese manufacturers of LED lights have to raise their prices to offset their rising costs of raw materials

18-07-2021

Selling Price increases have been the news in the LED industry. Cooper Lighting was the first big player to announce their price increase, and they were followed by: Maxlite, TCP, Signify, Acuity, QSSI, and Hubbell and more.

This price hike may arise from overall demand in the LED lighting market rebounding since the end of the year 2020 and remaining in an uprising price trend since the beginning of this year. Furthermore, the industry-wide shortage of LED components in the upstream supply chain, caused by the attack of the COVID-19 pandemic are compelling LED lights manufacturers to make more sourcing activities to store more materials this year in order to avoid possible shortage of materials they suffered last year.

In terms of the LED supply chain, the pandemic caused a hike costs of various materials because of insufficient supply, such as steel,copper and LED chips required for LED lights manufacturer last year. Facing the upward pressure of prices in their upstream supply chains, nearly all suppliers of LED lights have to raise prices accordingly to balance their costs for the ledl lights had been sold at excessively low retail prices.

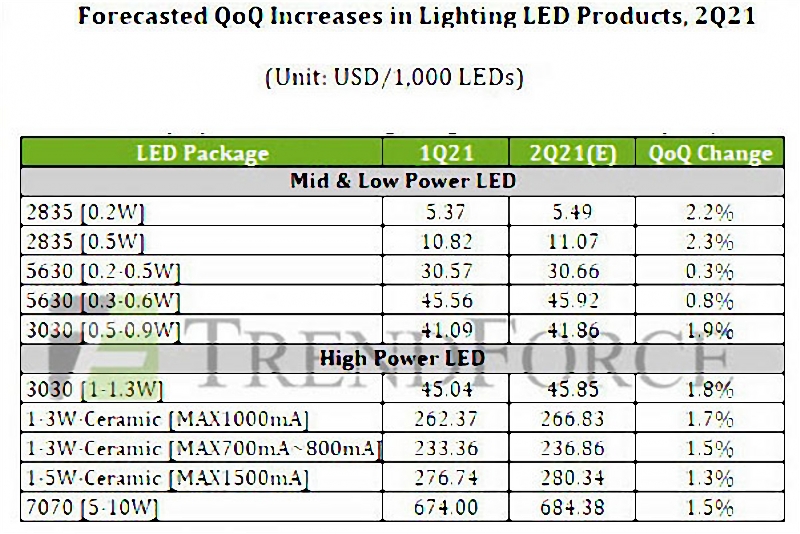

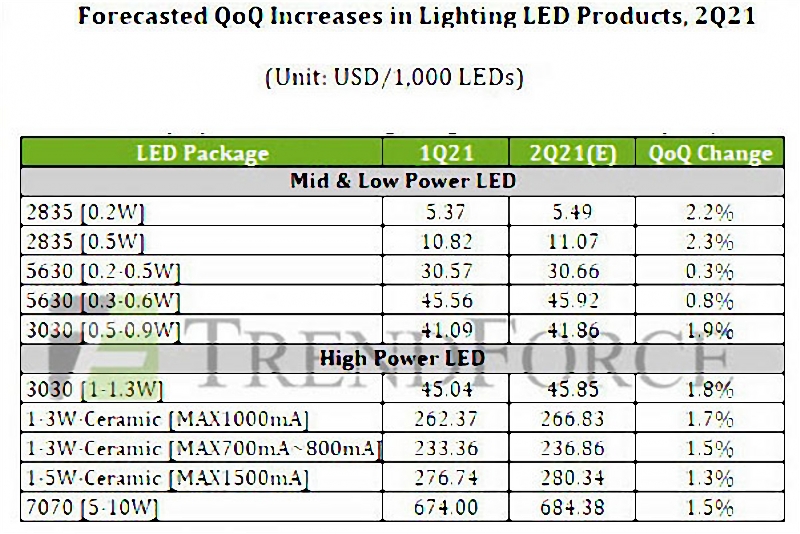

Specific LED chips that will experience a continued price hike cover mid- and low-power, indoor lighting LED products with under (not including) 1 watt in power consumption, such as 2835 LED, 3030 LED, and 5630 LED. Prices of these LED chips are estimated to increase by about 2.3 percent quarter over quarter in the year 2021. On the other hand, an about 1.8 percent quarter over quarter increase in prices will take place for outdoor, industrial high-power lighting LED products with at least 1 watt in power consumption and even high power LED chips.

Major suppliers of LED chips, for example, Samsung LED, ams/OSRAM, CREE LED, Lumileds, Seoul Semiconductor, MLS, and Lightning Optoelectronic, have achieved soaring business volume in the first half of the year 2021, which might persist through the end of the year 2021 owning to a quick rising demand for HCL (human centric lighting), smart lighting, horticultural lighting, and niche lighting (such as lighting for nuclear power stations, pharmaceutical manufacturing facilities, and metal fabrication plants).

Despite the price hike across upstream components, manufacturers of LED lights are still actively improving their current products performances, such as luminous efficacy and color saturation, and developing products that fulfill the requirement of post-pandemic applications in order to secure their market shares in anticipation of higher demand in the LED lights market.

All in all, it seems the LED industry has an optimistic outlook for quotation activity and business volume, but many do not see an increase in final revenue along with it. These results are interesting, given numerous recent headlines regarding price increases. It will be interesting to see how LED industry plays out and what the state of industry will actually be throughout 2021 as the world hopefully recovers from the pandemic in the year 2022.

This price hike may arise from overall demand in the LED lighting market rebounding since the end of the year 2020 and remaining in an uprising price trend since the beginning of this year. Furthermore, the industry-wide shortage of LED components in the upstream supply chain, caused by the attack of the COVID-19 pandemic are compelling LED lights manufacturers to make more sourcing activities to store more materials this year in order to avoid possible shortage of materials they suffered last year.

In terms of the LED supply chain, the pandemic caused a hike costs of various materials because of insufficient supply, such as steel,copper and LED chips required for LED lights manufacturer last year. Facing the upward pressure of prices in their upstream supply chains, nearly all suppliers of LED lights have to raise prices accordingly to balance their costs for the ledl lights had been sold at excessively low retail prices.

Specific LED chips that will experience a continued price hike cover mid- and low-power, indoor lighting LED products with under (not including) 1 watt in power consumption, such as 2835 LED, 3030 LED, and 5630 LED. Prices of these LED chips are estimated to increase by about 2.3 percent quarter over quarter in the year 2021. On the other hand, an about 1.8 percent quarter over quarter increase in prices will take place for outdoor, industrial high-power lighting LED products with at least 1 watt in power consumption and even high power LED chips.

Major suppliers of LED chips, for example, Samsung LED, ams/OSRAM, CREE LED, Lumileds, Seoul Semiconductor, MLS, and Lightning Optoelectronic, have achieved soaring business volume in the first half of the year 2021, which might persist through the end of the year 2021 owning to a quick rising demand for HCL (human centric lighting), smart lighting, horticultural lighting, and niche lighting (such as lighting for nuclear power stations, pharmaceutical manufacturing facilities, and metal fabrication plants).

Despite the price hike across upstream components, manufacturers of LED lights are still actively improving their current products performances, such as luminous efficacy and color saturation, and developing products that fulfill the requirement of post-pandemic applications in order to secure their market shares in anticipation of higher demand in the LED lights market.

All in all, it seems the LED industry has an optimistic outlook for quotation activity and business volume, but many do not see an increase in final revenue along with it. These results are interesting, given numerous recent headlines regarding price increases. It will be interesting to see how LED industry plays out and what the state of industry will actually be throughout 2021 as the world hopefully recovers from the pandemic in the year 2022.