NEWS

NEWS

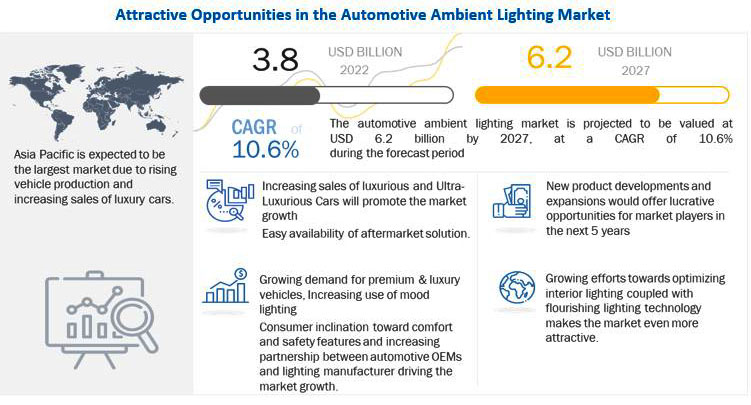

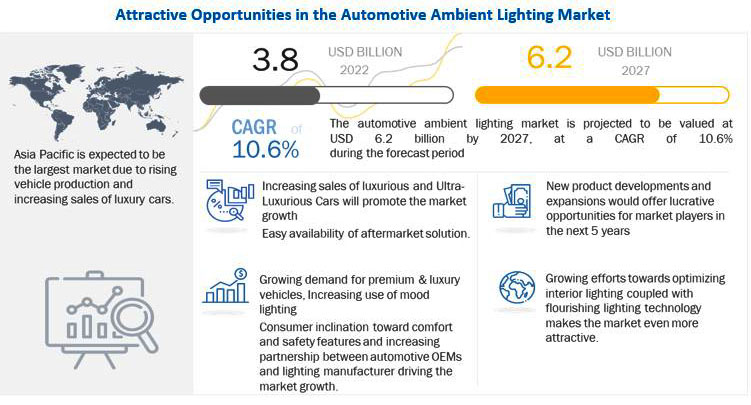

Brief market estimation about global automotive ambient lighting between 2022 and 2027

16-07-2022

The market volume of automotive ambient lights is estimated to be up to USD 3.8 billion by the end of 2022, it will grow at a CAGR of 10.6% from 2022 to 2027, it might be up to USD 6.2 billion by 2027. The growth of this market result from increasing demand of premium and luxury vehicles, more and more applications of mood lighting and multi-color ambient lighting in luxury vehicles.

The concept of ambient lighting is more and more popular among high-end automakers such as Mercedes-Benz, Lexus,BMW,Bentley and Rolls-Royce.Also, major automotive lighting suppliers are cooperating with OEMs to design newest products for the specific requirements of OEM. For example,ams Osram (Austria) worked together with BMW AG (Germany) to develop led laser headlights for the BMW 7 series.

As Original Equipment Manufacturers (OEMs) do not install automotive ambient lighting onto all vehicles, drivers generally get them installed from the aftermarket. In the case of C & D segment vehicles, OEMs provide automotive ambient lighting in the top level cars only. As the top cars are much more expensive, drivers will not buy them just for ambient lighting. They would prefer aftermarket ambient lighting kits. Thus, the aftermarket for ambient lighting is huge. OEMs generally have their own specifications to produce ambient lighting because brighter ambiance lights are a distraction; this aspect cannot be regulated when they are manufactured as an aftermarket lighting. This challenge may affect the growth of the OEM automotive ambient lighting market.

BEV segment is expected to occupy the largest market share of the electric vehicle ambient lighting.The globally increasing premium-end electric vehicles would also result in more market requirement for ambient lighting. Growing electric vehicle sales, including premium vehicles, would push the demand for ambient lighting consequently.

F segment cars is estimated to grow at the highest rate because of improving global economic conditions which has changed the overall lifestyle of consumers. Luxury brands, such as Mercedes-Benz, Lexus, and BMW, offers most vibrant and attractive ambient lighting solutions for modern cars. The ambient lighting is also popular and common feature in high-end cars such as Bentley and Rolls-Royce. As ambient lighting is very important in ultra-luxurious vehicles,increasing global production of F-segment vehicles is expected to drive the automotive ambient lighting market for F segment cars.

Asia Pacific is estimated to hold the largest share of the automotive ambient lighting OE market during . It has higher growth rate in vehicle production than Europe and North America because of labor at lower wages, reduced production costs and government orders for FDIs in the region in both pre and post-COVID-19. Most of the new vehicle production is made in the countries such as China, South Korea, India, and Japan, which accounted for ~88% of the total vehicle production in the region, and these countries occupy ~55% among the global vehicle production in 2021. Further, although the average penetration of ambient lighting in Asia Pacific is around 25-30% and 35-40% in C & D segments passenger vehicles separately in 2022, it is expected to reach 35-40% and 45-50% respectively by 2027. For this reason, increasing vehicle production and other changing consumer preferences for more customized options and growing per capita income of the middle-class population is resulting in more vehicle demand and encouraging automotive OEMs to increase production capacity and produce vehicles installed with varied ambient lighting systems in the lower-range cars,too.

The major players on global ambient lighting market is HELLA (Germany), Valeo S.A. (France), ams OSRAM (Austria), Grupo Antolin (Spain), Koito Manufacturing Co., Ltd. (Japan), Signify (Philip Lighting) (Netherlands), and Stanley Electric Co., Ltd. (Japan). These suppliers are adopting key strategies in terms of new product developments, expansions, mergers &acquisitions, and partnerships & collaboration to keep their market position.

The concept of ambient lighting is more and more popular among high-end automakers such as Mercedes-Benz, Lexus,BMW,Bentley and Rolls-Royce.Also, major automotive lighting suppliers are cooperating with OEMs to design newest products for the specific requirements of OEM. For example,ams Osram (Austria) worked together with BMW AG (Germany) to develop led laser headlights for the BMW 7 series.

As Original Equipment Manufacturers (OEMs) do not install automotive ambient lighting onto all vehicles, drivers generally get them installed from the aftermarket. In the case of C & D segment vehicles, OEMs provide automotive ambient lighting in the top level cars only. As the top cars are much more expensive, drivers will not buy them just for ambient lighting. They would prefer aftermarket ambient lighting kits. Thus, the aftermarket for ambient lighting is huge. OEMs generally have their own specifications to produce ambient lighting because brighter ambiance lights are a distraction; this aspect cannot be regulated when they are manufactured as an aftermarket lighting. This challenge may affect the growth of the OEM automotive ambient lighting market.

BEV segment is expected to occupy the largest market share of the electric vehicle ambient lighting.The globally increasing premium-end electric vehicles would also result in more market requirement for ambient lighting. Growing electric vehicle sales, including premium vehicles, would push the demand for ambient lighting consequently.

F segment cars is estimated to grow at the highest rate because of improving global economic conditions which has changed the overall lifestyle of consumers. Luxury brands, such as Mercedes-Benz, Lexus, and BMW, offers most vibrant and attractive ambient lighting solutions for modern cars. The ambient lighting is also popular and common feature in high-end cars such as Bentley and Rolls-Royce. As ambient lighting is very important in ultra-luxurious vehicles,increasing global production of F-segment vehicles is expected to drive the automotive ambient lighting market for F segment cars.

Asia Pacific is estimated to hold the largest share of the automotive ambient lighting OE market during . It has higher growth rate in vehicle production than Europe and North America because of labor at lower wages, reduced production costs and government orders for FDIs in the region in both pre and post-COVID-19. Most of the new vehicle production is made in the countries such as China, South Korea, India, and Japan, which accounted for ~88% of the total vehicle production in the region, and these countries occupy ~55% among the global vehicle production in 2021. Further, although the average penetration of ambient lighting in Asia Pacific is around 25-30% and 35-40% in C & D segments passenger vehicles separately in 2022, it is expected to reach 35-40% and 45-50% respectively by 2027. For this reason, increasing vehicle production and other changing consumer preferences for more customized options and growing per capita income of the middle-class population is resulting in more vehicle demand and encouraging automotive OEMs to increase production capacity and produce vehicles installed with varied ambient lighting systems in the lower-range cars,too.

The major players on global ambient lighting market is HELLA (Germany), Valeo S.A. (France), ams OSRAM (Austria), Grupo Antolin (Spain), Koito Manufacturing Co., Ltd. (Japan), Signify (Philip Lighting) (Netherlands), and Stanley Electric Co., Ltd. (Japan). These suppliers are adopting key strategies in terms of new product developments, expansions, mergers &acquisitions, and partnerships & collaboration to keep their market position.